In the aviation industry, trust and transparency in the supply chain are paramount. Every aircraft component must be traceable to its origin and maintenance history to ensure safety and compliance. However, recent incidents have exposed weaknesses in how parts are tracked. A notable example is the AOG Technics scandal, where a UK-based parts supplier allegedly sold engine components with forged documentation, leading to a global scramble to identify and replace suspect parts. Airlines had to ground numerous aircraft while hunting for these unapproved parts, incurring significant disruptions and costs. In fact, over 160 aircraft were taken out of service and inspected, resulting in tens of millions of dollars in losses for carriers. This crisis underscored an urgent need for better parts traceability solutions in aviation.

The High Stakes of Aviation Parts Traceability

The AOG Technics incident is far from an isolated case – it dramatically highlighted a long-standing challenge. The aviation supply chain handles millions of parts, from critical engine components to minor fasteners, often moving between manufacturers, distributors, maintenance, repair and overhaul (MRO) shops, lessors, and airlines. If even one part is counterfeit or has falsified paperwork, the risks are enormous: safety can be compromised, regulatory compliance violated, and airlines may face costly groundings. History shows the danger – between 1973 and 1993, counterfeit or unapproved parts contributed to at least 166 aviation accidents or incidents in the U.S. In response, regulators like the FAA established programs such as the Suspected Unapproved Parts (SUP) program in 1995 to crack down on bogus components. Yet the problem persists; since 2011, the FAA's SUP program has identified over 3,000 cases of unapproved parts entering the system. This indicates that traditional tracking methods (reliant on paper certificates, siloed databases, and trust in supplier integrity) are not foolproof.

For aviation businesses, the implications are serious. An undetected fake or faulty part can lead to in-flight engine failure or other malfunctions. Even short of catastrophe, discovering an untraceable part triggers expensive corrective actions. Airlines suffer lost revenue when aircraft are grounded unexpectedly (an Aircraft on Ground situation can cost an airline tens of thousands of dollars per day). MROs must quarantine suspicious parts and conduct time-consuming investigations, delaying repairs. Lessors and OEMs worry that counterfeit parts could devalue assets or erode brand reputation. In the wake of the AOG Technics scandal, for example, CFM International (the manufacturer of CFM56 engines) found at least 126 engines worldwide that contained parts with suspect documentation. Major carriers like American Airlines, United, and Southwest had to pull aircraft from service for urgent inspections – a logistics nightmare for maintenance scheduling. It became abundantly clear that the industry's existing paper-based traceability systems were too vulnerable to fraud and error.

The AOG Technics Scandal: A Wake-Up Call

The AOG Technics case has been described as potentially "the most dangerous scam in aviation history". In this scheme, the supplier falsified certifications and documents for critical engine parts over a period of years. Operators unknowingly installed these parts in aircraft engines, believing they were legitimate.

The house of cards fell in 2023 when regulators in the UK, EU, and U.S. issued safety alerts after discovering the fraud. Airlines worldwide had to scramble to identify where those parts went. Dozens of aircraft were grounded for emergency inspections, and an international investigation was launched. Authorities revealed that AOG Technics had even created fake employee identities and provided false office addresses to appear credible. The fallout was extensive – while thankfully no accidents occurred, the incident eroded confidence in the parts supply chain.

Most importantly, the scandal was a wake-up call on how critical it is to verify the provenance of every part. If all components had a verifiable history accessible to stakeholders, it would be far harder for a "rogue actor" to inject fraudulent parts. As former NTSB Chairman Robert Sumwalt put it, "One bad actor is one too many in an industry so focused on quality and safety." The industry recognized that more robust systems and collaboration were needed to prevent this from happening again.

Industry Response: Strengthening Supply Chain Integrity

In early 2024, leading aviation organizations came together to form the Aviation Supply Chain Integrity Coalition (ASCIC). Spearheaded by GE Aerospace and including major players such as Airbus, Boeing, Safran, American and United Airlines, Delta Air Lines, and MRO giant StandardAero, this coalition's mission was to close the loopholes that allowed unapproved parts to slip through. By October 2024, the coalition released a report with 13 recommended actions aimed at tightening parts traceability and verification across the industry. These voluntary measures complement regulatory efforts and set a new baseline for best practices. Key recommendations include:

- Accredited Suppliers Only: Airlines and MRO shops should source components only from vetted suppliers accredited by FAA or EASA programs. This reduces the chance of buying parts from obscure middlemen with fake credentials.

- Industry Oversight & Vendor Database: Establish a new industry-run entity to oversee parts suppliers and maintain a shared database of accredited vendors. This creates transparency about who is approved to sell aviation parts.

- Digital Documentation Standards: Shift from paper certificates to digital parts documentation and adopt industry-wide standards for record-keeping. Digital records are harder to falsify and easier to share and audit.

- Workforce Training: Improve training for technicians and inspectors to help them identify signs of unapproved or counterfeit parts in the field. Human vigilance remains a line of defense alongside technology.

- Lifecycle Part Tracking: Implement better tracking to ensure that when a part is retired or scrapped, it cannot re-enter the supply chain. For example, a database flagging scrapped parts can prevent rogue resellers from recycling them.

"These recommendations will close holes and add new layers of safety to strengthen the integrity of the supply chain," said Coalition co-chair Robert Sumwalt. Notably, most of these actions can be supported – or even fully enabled – by blockchain technology. In fact, the coalition's report organizes its recommendations into themes like strengthening vendor accreditation and digitizing documents – precisely the areas where blockchain-based platforms excel.

How Blockchain Enhances Traceability and Trust

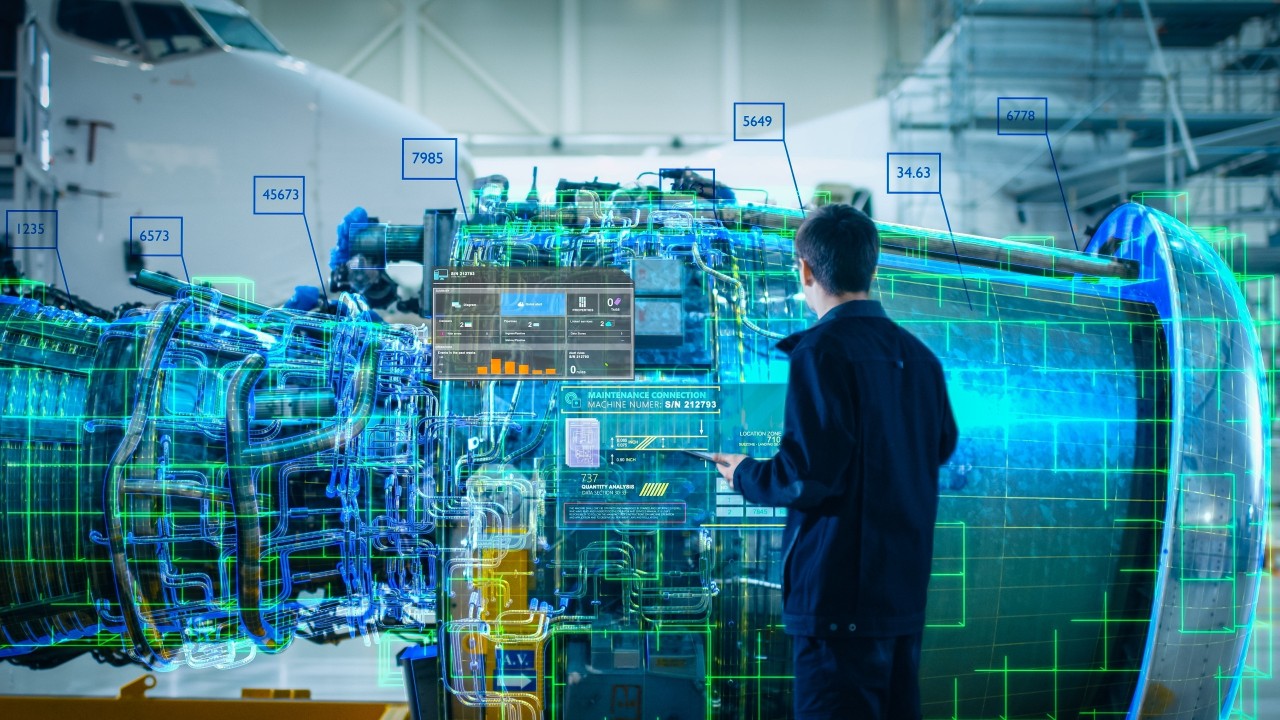

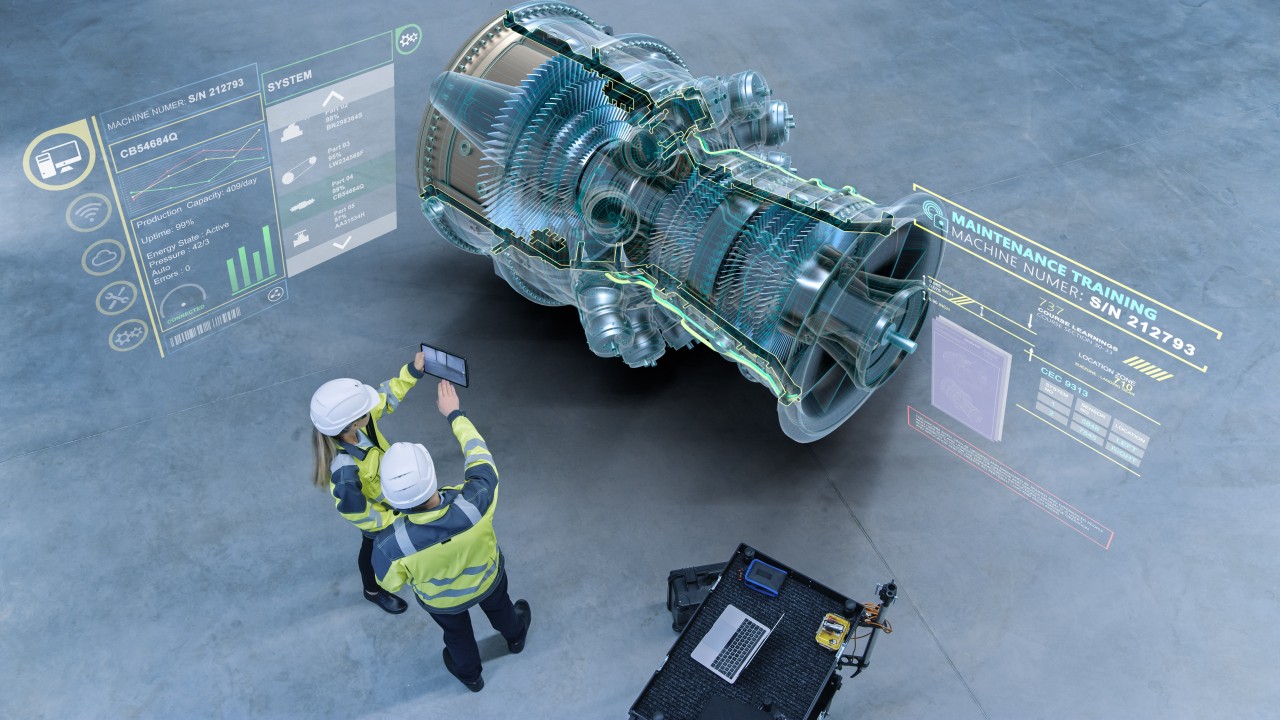

Blockchain is essentially a secure, distributed digital ledger. It allows multiple parties (manufacturers, suppliers, airlines, lessors, MROs, regulators, etc.) to record transactions and data in a tamper-proof, immutable manner. Once information is on the blockchain, it cannot be altered without detection, and all authorized participants can access a single source of truth. This technology is proving to be a game-changer for supply chain management because of its ability to record and verify data with full transparency. As Deloitte observes, blockchain can log all essential information about a part – its origin, manufacture date, supplier, quality inspections, certifications, repairs, etc. – thereby improving visibility across the supply chain and making it far easier to audit the entire lifecycle of a product. For aviation, that means every time a part changes hands or gets installed, the event is documented in a secure ledger accessible to those who need to know.

Crucially, blockchain directly addresses the aviation coalition's focus areas:

Vendor Accreditation

A blockchain-based system could include a registry of approved vendors where each supplier's credentials are recorded and updated by a trusted authority. Airlines and MROs would quickly verify a vendor's status on the ledger before purchasing, making it difficult for unapproved sellers to operate.

Digital Documentation

Instead of paper certificates that can be lost or forged, digital certificates for parts can be issued and stored on blockchain. For example, when an OEM manufactures a part, it could publish a digital birth record (with serial number, specs, compliance statements) to the blockchain. Any authorized buyer can later retrieve and verify this record. Because the ledger is immutable, counterfeiters cannot alter or fake these documents.

Unified Database & Standards

Blockchain inherently provides a shared data platform. All participants see the same records, which encourages adoption of common data standards industry-wide. It's a built-in single database of parts history, rather than each company keeping its own siloed logs.

Traceability from Cradle to Grave

As parts move through their life – from OEM to perhaps a surplus distributor, to an airline, through repairs at MROs, and eventually to retirement – each transaction or maintenance event can be appended as a new "block" in that part's history. The result is a back-to-birth traceability chain that is extremely difficult to falsify or break. If a part is scrapped, the blockchain record can mark it as such permanently. Anyone checking that part's ID would see a scrapped status and know not to use it, closing the door to recycling of banned parts.

Audit and Accountability

With a complete, tamper-proof history of parts, regulators and companies can audit compliance far more efficiently. If a dubious part appears, its provenance can be checked in minutes by querying the blockchain record. This kind of end-to-end visibility drastically reduces the time to identify issues and trace all other aircraft that might have received a bad batch, for instance. It also deters fraud – knowing that every action is logged and visible to stakeholders discourages would-be counterfeiters.

In summary, blockchain offers the aviation supply chain a tool to streamline record-keeping and enhance trust. Unlike traditional databases or paper logbooks, a blockchain-based system creates an unalterable digital trail for each component, which all relevant parties (from OEMs to airlines) can collaborate on securely. Some major aerospace companies are already leveraging this. For example, Honeywell's GoDirect Trade platform for aircraft parts uses blockchain to replace paper documents with digital records, creating an immutable history of each transaction and maintenance event. This has instilled greater confidence in the used parts market by ensuring that buyers can trust the documentation that comes with a component. Ultimately, blockchain's core features of data integrity, transparency, and decentralization directly mitigate the weaknesses that the AOG Technics case exposed.

Blockchain Solutions in Action in Aviation

Blockchain is being combined with advanced technologies like AI-based part fingerprinting to ensure every component's identity and history are verified. Several forward-looking companies have begun implementing blockchain-based traceability, often alongside other innovations, to secure their supply chains.

The industry is also seeing new marketplaces and platforms emerging that build blockchain into their core. For instance, startup ventures have created B2B online marketplaces for aviation spares where every transaction is logged on a blockchain ledger. This means when an airline or MRO buys a part through the platform, the part's digital passport is automatically updated on the ledger – showing who sold it, who bought it, and verifying its documentation. One such marketplace claims to be the first to offer this capability for aircraft spares, integrating blockchain to provide end-to-end traceability for every item bought or sold. The advantage of these platforms is that traceability becomes a by-product of doing business: users get a transparent, tamper-proof trail without having to do extra paperwork, and they can be confident in the parts they purchase.

These real-world implementations demonstrate that blockchain isn't just theoretical hype for aviation – it's already delivering solutions. From OEMs to tech startups, stakeholders are investing in blockchain networks as a foundation for a more secure supply chain. As a result, the post-AOG Technics world is likely to see much wider adoption of distributed ledgers to restore trust and safety.

Benefits for Key Stakeholders

A blockchain-based aviation parts tracing system stands to benefit every player in the industry's ecosystem. Here's how it helps each group achieve their goals and mitigate risks:

Airlines

Improved safety and reliability of operations. Airlines can be confident that every part installed on their aircraft has a verified history and is airworthy. This reduces the risk of in-flight failures and prevents costly AOG situations caused by unapproved parts. It also streamlines regulatory compliance and reporting, since the maintenance records and part certificates are readily available on the ledger.

MROs (Maintenance, Repair & Overhaul providers)

Greater efficiency and accuracy in maintenance processes. An MRO can quickly check a part's blockchain record to verify its status (serviceable, time since overhaul, etc.) before installation, eliminating guesswork. This speeds up turn-around times for repairs and reduces the incidence of quarantined parts that lack proper paperwork. MROs also spend less effort on manual record-keeping, as data entries are securely shared among parties.

Lessors

Enhanced asset value protection. Aircraft leasing companies need to ensure that the assets they own (airframes and engines) are maintained with legitimate parts. Blockchain provides lessors with a transparent log of all parts changes and maintenance on their leased aircraft, which is invaluable during audits or transitions between lessees. It helps preserve the asset's resale value and avoid penalties by ensuring compliance with all contractual and regulatory requirements for approved parts.

OEMs (Original Equipment Manufacturers)

Better quality control and brand protection. For aircraft and engine manufacturers, blockchain can act as an extended warranty book that tracks their products in the aftermarket. OEMs can trace if and when non-genuine parts are used as replacements and can more easily pinpoint counterfeit parts claiming to be from them. This feedback loop helps OEMs take action against counterfeiters, issue timely service bulletins, and maintain the integrity of their brand. Additionally, data analytics on the blockchain usage of their parts can inform product improvements and spares forecasting.

Towards a Safer, Transparent Future

The challenges of aviation parts traceability are now being met with innovative solutions, and blockchain is at the forefront of this transformation. By creating an ecosystem of trust, where every transaction and handoff of a component is recorded indelibly, blockchain closes many of the gaps that bad actors have exploited in the past. It enables the industry to move from reactive firefighting – scrambling after a scandal to identify issues – to a proactive stance where unapproved parts are spotted and stopped before they ever make it onto an aircraft.

Equally important is the collaborative aspect: a blockchain network for parts requires industry-wide participation. The post-AOG Technics initiatives show encouraging signs of this teamwork, from global airlines and manufacturers co-developing traceability networks, to coalitions aligning on data standards.

Aviation has always held safety as its core value, and embracing blockchain to secure the supply chain is a natural extension of that principle. As more companies adopt these systems, we can expect fewer incidents of counterfeit parts, faster verification of components, and a stronger confidence across airlines, MROs, lessors, and OEMs that the parts keeping airplanes in the sky are exactly what they purport to be.

Conclusion

In conclusion, blockchain is changing aviation parts tracing by providing an unprecedented level of transparency, security, and efficiency. What began as a response to a crisis is fast becoming a new industry standard. By digitizing trust, the aviation world is ensuring that the parts underpinning air travel are tracked and verified from manufacture to retirement. The result will be a safer aerospace sector and a more resilient supply chain – one where incidents like AOG Technics are relegated to history, and the focus remains on keeping airplanes flying safely with genuine, traceable parts.